Here are some of the precautions you should take to prevent the horror of identity theft:

Place secure passwords on your credit card, bank and phone accounts. Don’t use information such as your mother’s maiden name, your birth date, the last four digits of your Social Security Number or phone number, or any series of consecutive numbers.

Place secure passwords on your credit card, bank and phone accounts. Don’t use information such as your mother’s maiden name, your birth date, the last four digits of your Social Security Number or phone number, or any series of consecutive numbers.- Order a credit report from each of the three major credit bureaus once a year. This can help you catch mistakes and fraud before they wreak havoc on your personal finances.

- Don’t give out personal information over the phone, through the mail or over the Internet unless you’ve initiated the contact or are sure who you’re dealing with.

- Put mail in collection boxes or drop it off at your local post office, rather than leaving it in your own mailbox for pickup. Promptly remove mail from your mailbox. If you’re planning to be away from home, ask the Post Office for a vacation hold.

- Tear or shred charge receipts, credit applications, insurance forms, physician statements, checks and bank statements, expired charge cards and credit offers before throwing them in the trash.

- Don’t carry your Social Security card. Give out the number only when necessary. Try to use other forms of identification. Carry only the identification and credit and debit cards that you actually need.

- Be suspicious of correspondence from your bank or the IRS. In one scam, the promoters sent out fictitious bank correspondence and phony IRS forms in an attempt to trick the recipients into disclosing personal and banking data. The thieves then used the information to impersonate the recipients and gain access to their finances. “Genuine IRS forms do not ask for sensitive personal and financial data except in very special circumstances,” the IRS notes.

If you find yourself the victim of theft, take these steps immediately:

- Cancel your credit cards.

- File a police report in the jurisdiction where the crime took place.

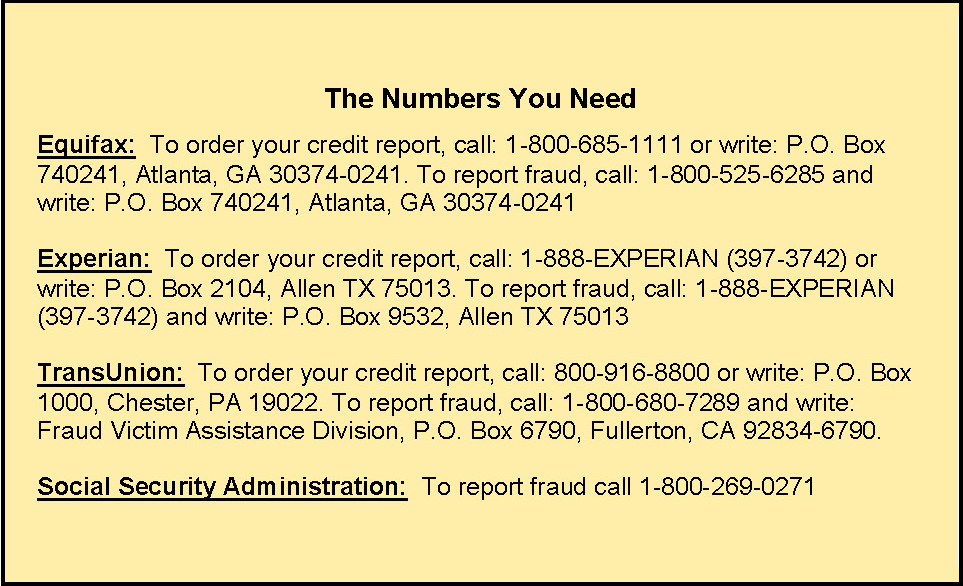

- Call the three national credit-reporting organizations immediately to place a fraud alert on your name and Social Security number. After that, any company checking your credit will know your information was stolen. They will have to contact you by phone to authorize new credit. (See below for the numbers to call.)

With a bit of vigilance, you can save yourself the upheaval, stress and potential losses that happen when a person’s identity is stolen.